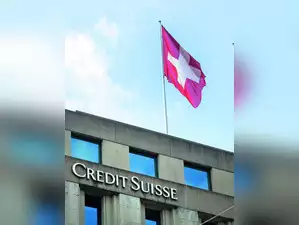

Credit Suisse’s largest shareholder, the Saudi National Bank, wanted to raise its stake to 40% ahead of the Swiss bank’s collapse in March, Swiss newspaper Blick reported.

The lender, which held just under 10% of Credit Suisse shares, had approached the Swiss government and regulators with a group of investors to inject $5 billion into the beleaguered bank, according to the newspaper, which cited two sources it didn’t identify.

Swiss regulator Finma vetoed the investment offer, Blick reported. Under Swiss law, major foreign shareholders must receive approval from Finma to own a larger than 10% stake in a Swiss bank.

The Saudi National Bank didn’t immediately respond to requests for comment. Credit Suisse declined to comment. Finma didn’t respond to requests for comment from Bloomberg News outside of normal business hours.

Credit Suisse was acquired by UBS Group AG in an emergency deal in March, brokered by the Swiss government. The Saudi National Bank’s Credit Suisse holdings were converted to about a 0.5% stake in UBS after the lenders completed the deal.

The Saudi bank’s former chairman, Ammar Al Khudairy, resigned days after his comments to Bloomberg TV helped trigger the slump in the stock and bonds that prompted the Swiss government to step in and arrange the takeover.